Rental Fraud on the Rise: How to Prevent Scammer Tenants from Moving In

Property rental fraud is another type of fraud that is surging, with more than 70% of major apartment landlords reporting an increase in fraudulent rental applications during 2023, according to the National Multifamily Housing Council and the National Apartment Association. Due to pro-tenant laws that make eviction procedures very strict, combined with a backlog in eviction proceedings, law enforcement is simply not evicting people. Some tenant protections enacted during COVID have remained in place, which is also leading to fewer evictions.

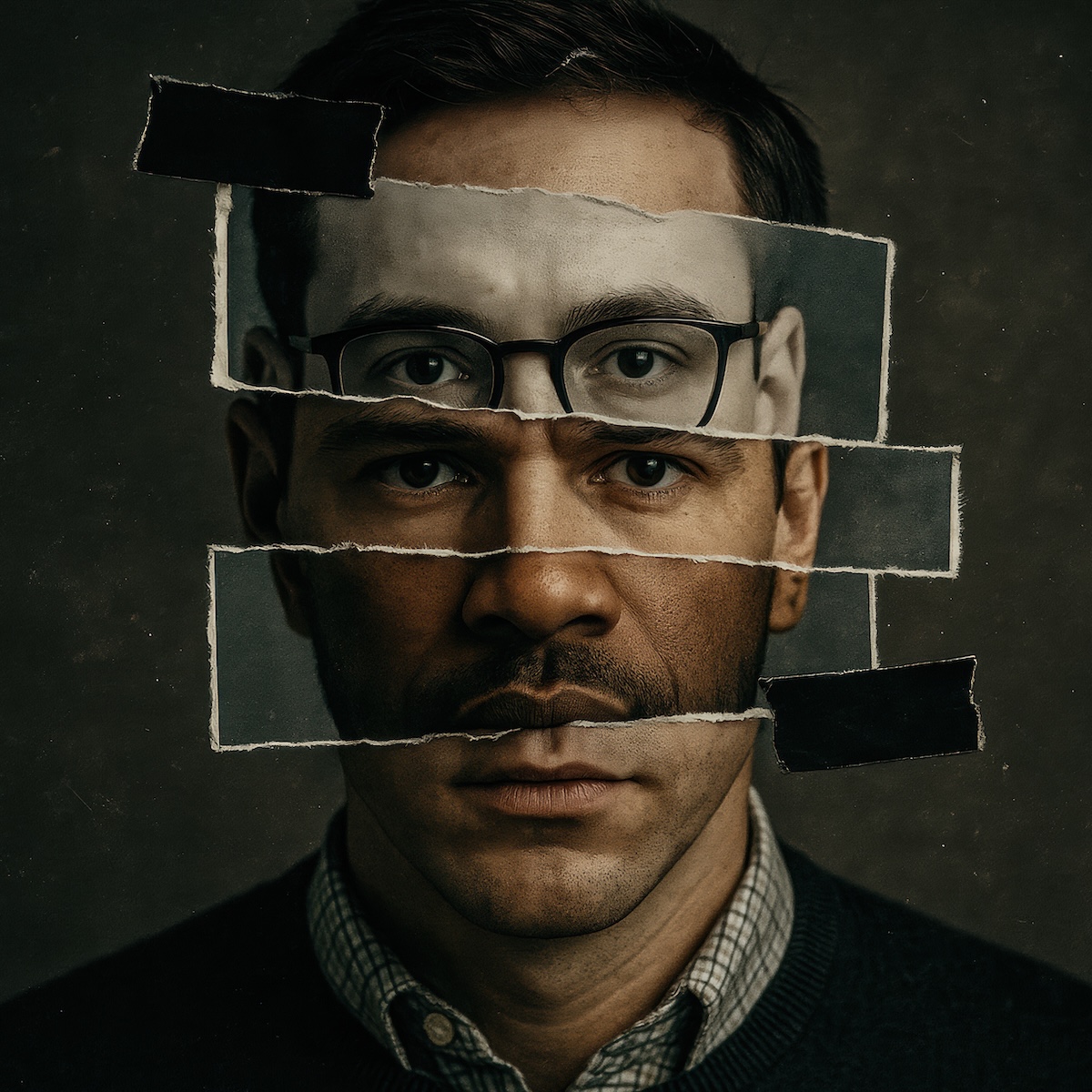

Rental fraud happens when renters lie about who they are, or lie about their income and ability to pay. There are often leasing incentives - free months with no rent due - which allow fraudsters to live rent free for many months without being discovered. Property managers are left with tenants who cannot pay the rent and who would not have qualified to rent the unit were it not for fraudulent documents. Unsurprisingly, there is a high correlation between cities with low eviction rates and high levels of rental fraud, which underscores the need for managers to verify applicant identity before leasing a property.

Putting a bit of friction, such as knowledge-based authentication (KBA), in the process has deterred some fraudsters, but most rental companies are not used to deploying technology to authenticate identity. They are instead turning to old-school methods like calling employers and asking for W-2 forms, which turns many applicants off from the process. But property managers are simply not equipped to be fraud investigators, and they find the role uncomfortable, for a few reasons:

- They find the training too difficult or cumbersome (too many steps)

- They fear being accused of violating fair housing laws if they are not 100% consistent in how they use their screening process and are accused by renters of not screening fairly

Some property managers use identity verification products, while others require bank login like Plaid to verify bank accounts and assets. But there is no all-in-one solution for managers to measure a credit risk, and many end up using several different technologies to create a patchwork solution to verify identification and financial health.

A single technology or supplier would have to meet a number of requirements to be a smart choice for property managers to avoid fraud by bad actors:

- It has to work, of course

- It has to be easily integrated into the manager’s rental workflow

- It has to take on the burden of support calls

- It has to take on the burden of complying with fair housing laws

- It has to be a good fit for the property’s clientele and demographics.

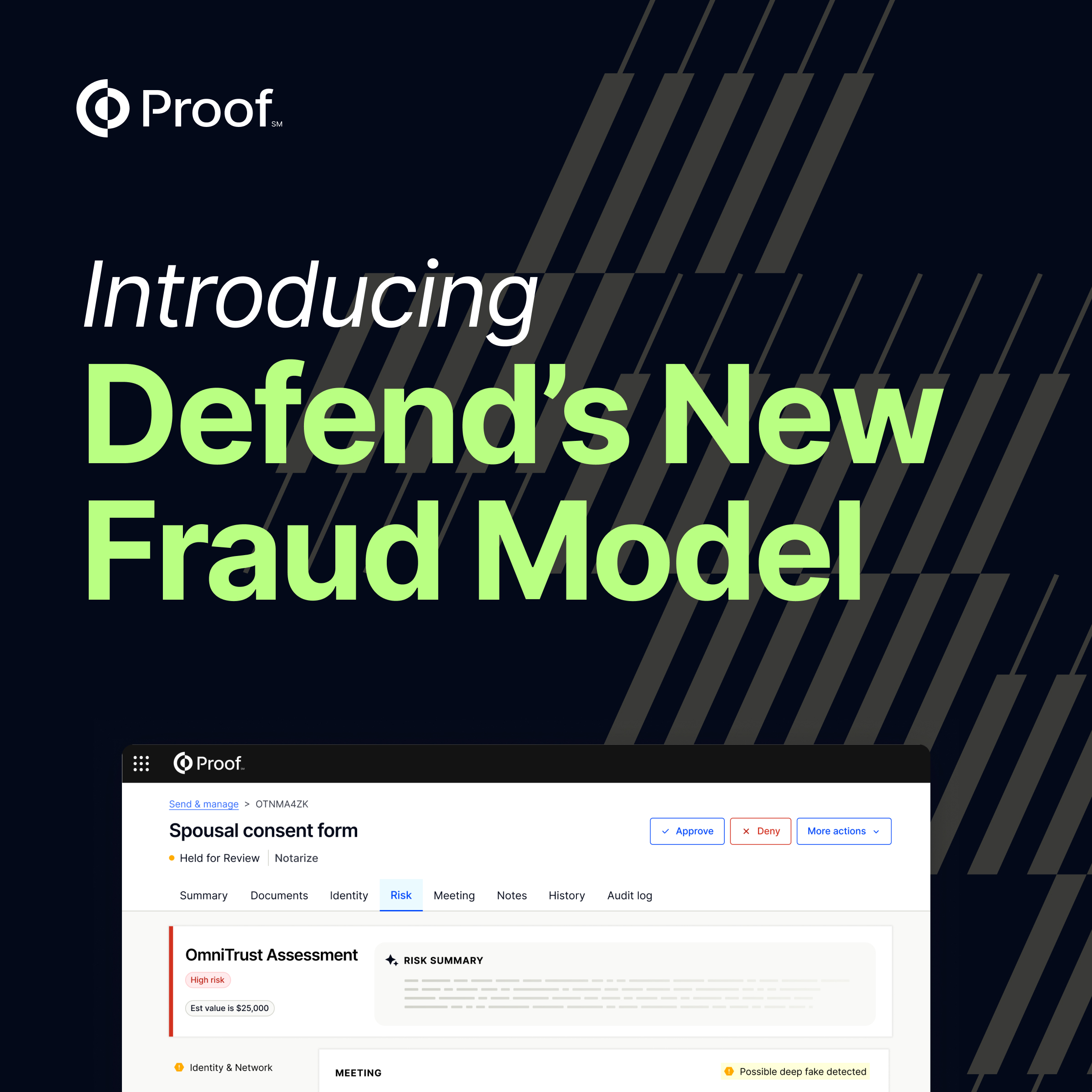

This is why we’ve built Proof – to bring trust to every transaction on the internet. Defending your business and customers against fraud requires a layered approach.

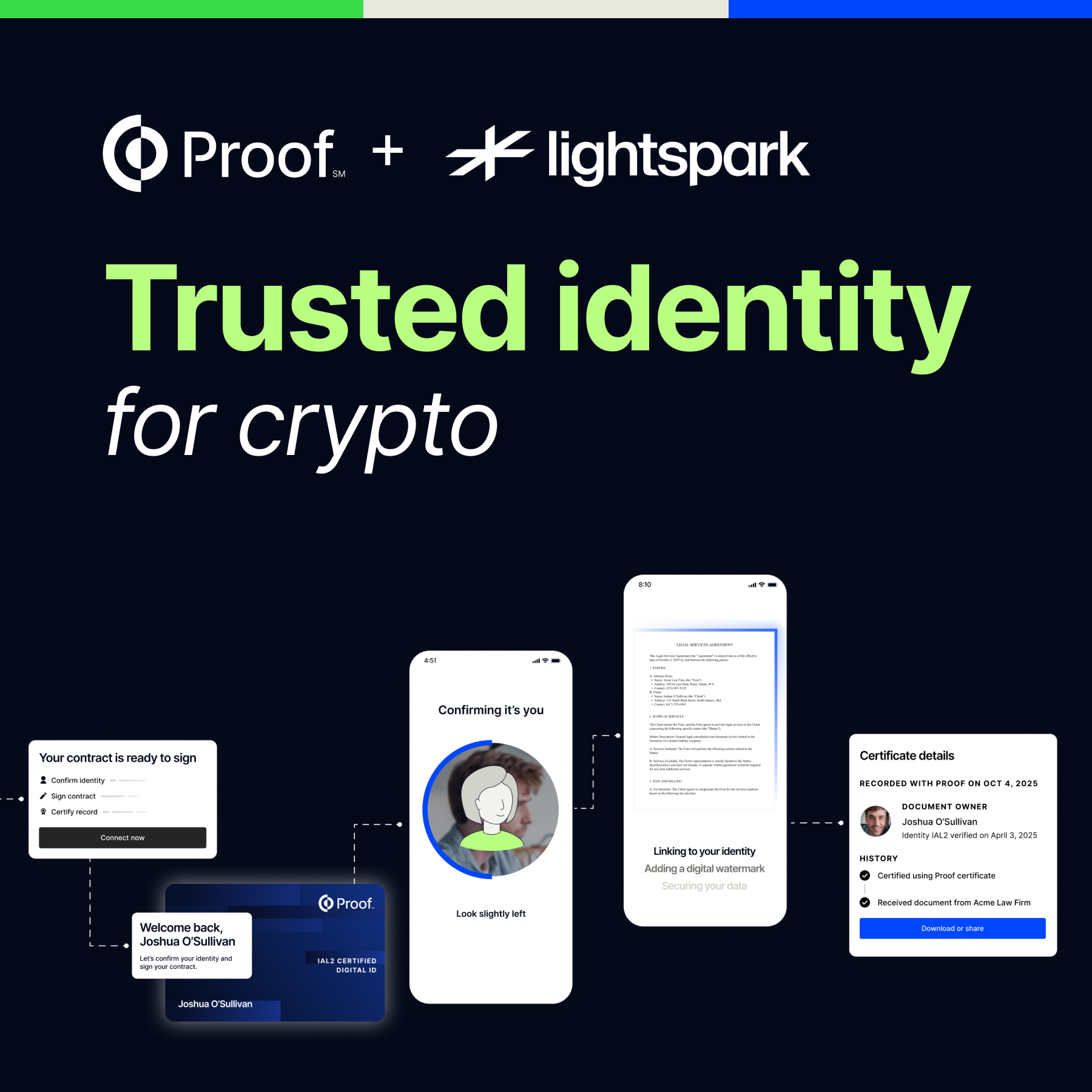

In Proof, rental companies now have a clean and easy solution to validate new rental applicants. Instead of using multiple technologies and sending customers to different verification methods, a company can put a simple link on their website for a customer to verify their identity. Proof will then scan a person’s ID, validate that the person physically in front of the camera matches the person on the ID and then run this applicant’s information through an industry-leading fraud decision engine. If successful, the applicant will sign a form to confirm their identity.

.png)

In the end, the rental company receives a Proof Identity Report, which captures all the information that was verified and provides the company with all the evidence. If Proof rejects an applicant due to fraud, there’s no risk of a rental agent being accused of not being completely objective or being inconsistent from applicant to applicant.And if an applicant can’t verify their identity, they will immediately be connected to a live human: a notary from the Notarize Network. Notaries can also serve as a trusted agent to verify an identity, with almost no wait times and no need for an appointment. Applicants are seamlessly routed to a notary when they can’t complete the automated verification. This ensures that all rental applicants are able to complete the process and there’s an equitable process for verifying every person’s identity.Ready to get started? Click here to reach out to our team.

.png)

.jpg)