Baxter Credit Union Enhances Member Experience with Proof

Millions of Americans join a credit union every year, and more than 100 million members nationwide take advantage of services from auto loans to home refinancing.

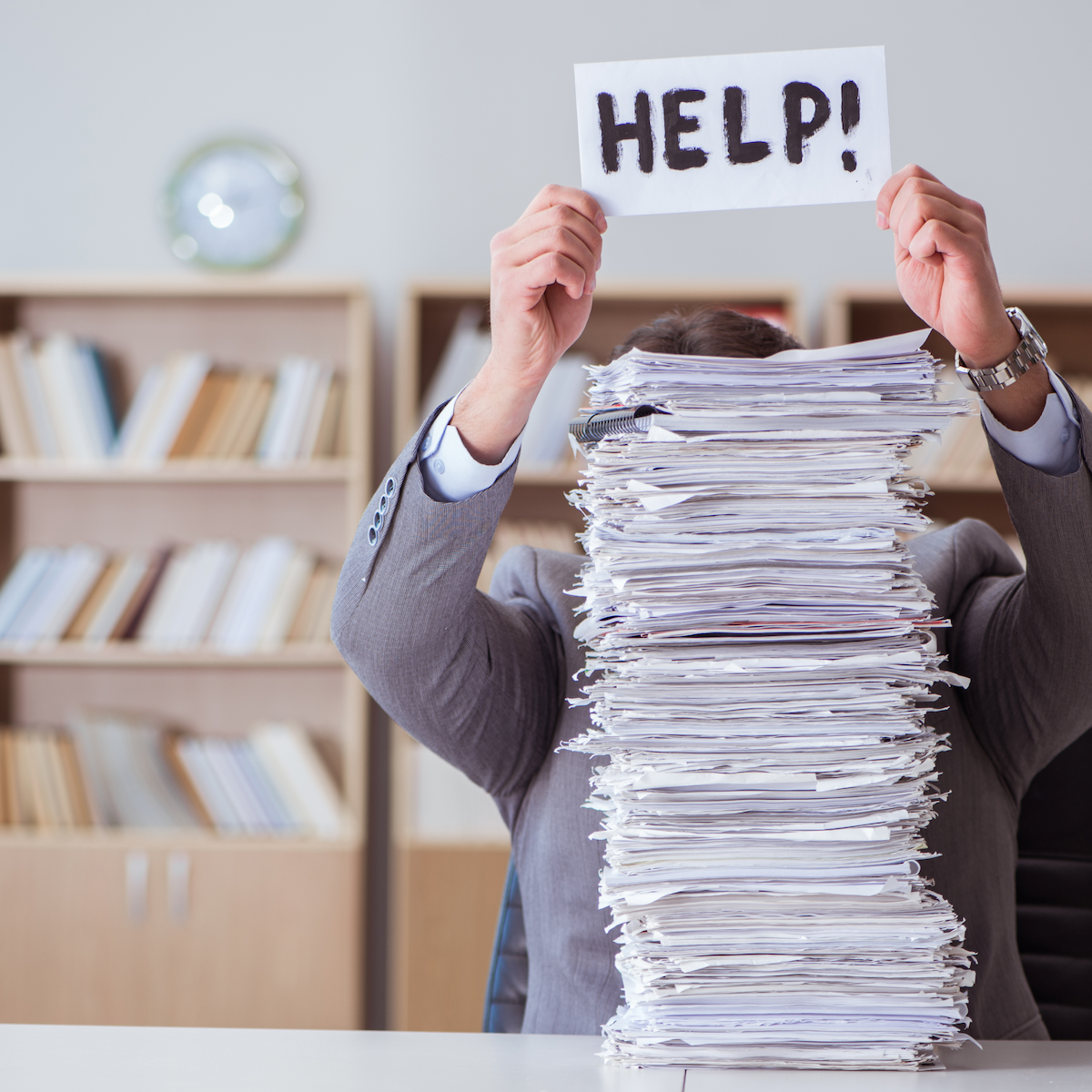

With more and more people turning to credit unions for their finances, they’re demanding digital-first solutions. The majority of documents needing to be signed and notarized, whether it be for 401k withdrawal or powers of attorney forms, are still done in paper.

That’s why credit unions are adopting technology to change the way they serve their members.

Baxter Credit Union Chooses Notarize

Baxter Credit Union (BCU) is one of the largest credit unions in the country. Serving almost 250,000 members in the United States and Puerto Rico, BCU has been pushing the boundaries on how they serve customers for nearly 40 years.

One of their largest lines of business – auto loan financing – has seen a spike in popularity in the last decade.

Before using Proof, BCU had been asking its members to sign and notarize paper power of attorney forms in order to use their car as a lien should the member default on their loan payment. Because the POA was done on paper, the loan and lien forms were rarely completed in the same timeframe, requiring BCU to take on more loan risk without guaranteed collateral.

“We actually found Proof (formerly Notarize) by accident,” said Allison Yaney, Supervisor of Consumer Loan Servicing and Consumer Titles. “We were looking to send mobile notaries to the homes of our members to make the notarization process easier, and discovered it could be done entirely online. Since then, Proof has helped reduce a process in paper that took days to complete, to an average of 15 minutes that gets sent right to our system. It couldn’t be easier.”

BCU is also leading the charge in working with DMVs across the country to accept electronically notarized documents, nearly all of which have been accepted without issue.

Expanding Proof to More Branches and Departments

When BCU first started using Proof, the initiative was led by a handful of employees. The number of users has since tripled, and the credit union is thinking about ways to offer Proof as a service to other branches and departments outside of auto lending.

In its current use case, BCU is changing the way it is issuing loans. With ambitions to be one of the most technology-forward credit unions in the country, BCU is building a digital suite of tools and services that will help them fund loans the same day a member applies. To do this, they are streamlining the loan sales department process and doubling down on how they can use this technology to improve the member experience.

“Everyone says it’s an easy and ‘kind of weird’ experience,” said Yaney. “I can’t think of any other business that allows their customers to have a FaceTime-like experience over your phone. It’s just better for our members, and better for our business.”

.jpg)

.png)

.png)

.png)